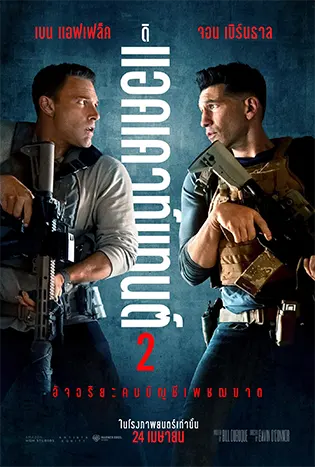

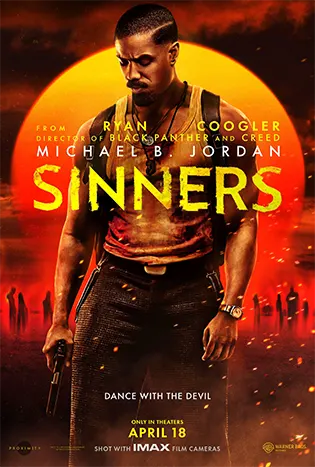

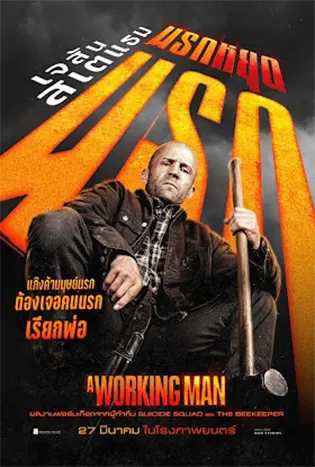

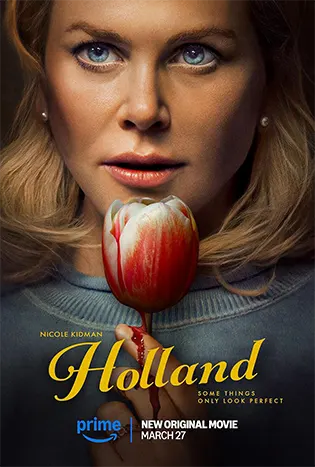

ดูหนังออนไลน์ 2025 ฟรี HD หนังใหม่ แนะนำ พากย์ไทย ซับไทย เต็มเรื่อง

ดูหนังออนไลน์ฟรี 2025 ชัด HD เต็มเรื่อง เว็บดูหนังออนไลน์ nikoganda ดูหนัง netflix ล่าสุด หนังชนโรง พากย์ไทย ซับไทย มีให้เลือกชมทั้งความระเอียด 4K Zoom หรือ Full HD 1080P ซีรีย์ไทย เกาหลี ซีรีส์ฝรั่ง 18+ แนะนำ ค้นหาหนังที่คุณต้อง ซีรีย์มาใหม่ การ์ตูนอนิเมชั่นต่างๆ ดูหนังออนไลน์ฟรีไม่กระตุก อัพเดทหนังใหม่ ดูหนังออนไลน์พากย์ไทย , รวมหนังออนไลน์พากย์ไทยน่าดู รวมหนังมาแรง และหนังชนโรง 2025 หนังคุณภาพชัด ดูได้ที่นี่ก่อนใคร ทั้งในคอมและบนมือถือทุกระบบ โหลดเร็ว ไฟล์ไม่เสีย มีลิ้งดูหนังสำรอง หนังอัปเดตใหม่มีเรื่องอะไรน่าสนใจบ้าง ไปดูกันเลยค่ะ! แนะนำหนัง ซีรีส์น่าดูทั้งจาก Netflix, Disney Plus, VIU, HBO, Amazon Prime Video และบริการสริมมิ่งชื่อดังอื่นๆ อีกมากมาย

เว็บดูหนังออนไลน์ฟรี ไม่มีโฆษณา ที่มีหนังและซีรีย์ รวมถึงกร์ตูน แอนิเมชั่นให้เลือกดูกว่า 7000 เรื่อง สามารถเลือกดูเลือกชมได้อย่างจุใจ นอกจากนี้หากอยากดูหนังเรื่องไหนที่ไม่มีภายในเว็บไซต์ สามารถขอหนังที่ต้องการดูได้ เราอัพเดตหนังทุกวัน รวมหนังใหม่ ดูหนังออนไลน์ หนังใหม่ชนโรง ซีรีส์จีน ซีรีส์เกาหลี ซีรีส์ไทย อนิเมะถูกลิขสิทธิ์ ดูฟรีไม่สะดุด ไม่มีโฆษณากวนใจ สามารถดูได้ผ่าน Smart TV , Android , iOS ได้ทุกเครือข่าย มีให้คุณเลือกดูครบไม่ว่าจะเป็น หนังไทย หนังฝรั่ง หนังจีน เกาหลี หรือจะเป็น หนัง Netflix คุณไม่จำเป็นต้องเสียเงินอีกต่อไป ระบบดูหนังของเรานั้นมีให้เลือก ทั้งหนังพากย์ไทย และ ซับไทย มีตัวเล่นหนังสำรองป้องกันหนังเสีย ระบบซ่อมหนังอัตโนมัติ และที่สำคัญสามารถ ดาวน์โหลดหนังฟรี ได้ครบทุกเรื่อง